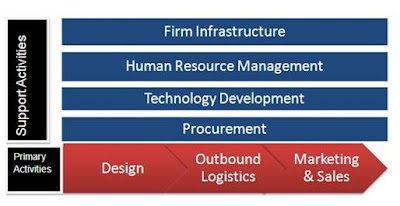

Firm Infrastructure

It was Ortega’s,

the founder of Inditex, visionary management style which led Inditex towards

success. It was his concept to deliver fashion quick because he was interested

in revolutionalizing the apparel industry where the customers must regard

clothing as a perishable commodity. To serve his viewpoint integration of

designing, manufacturing & distributions were integral to the fast-fashion

concept. Most of Inditex’s

competitors adopt an outsourcing strategy by outsourcing all production to the

external suppliers whereas Inditex maintains its production processes in house.

The supply chain structure is vertically integrated.

|

| Brands which make Inditex |

Human Resources Management (HRM)

Inditex is an

employer to more than hundred thousand individuals coming from 150

nationalities.Many of the

Inditex’s current managers began their careers as store employees or other

entry level positions. There performance was recorded and talented employees

were promoted.Orientation of new employees & training of existing employees

adapting to their needs is given importance in the organization.

Technology Development

Inditex achieved

a competitive edge over its competitors by developing a quick response system

to fashion trends & for this it had to develop state-of-the-art IT system

which is integrated throughout the supply chain.

There is

constant exchange of information through every part of supply chain which

includes shop managers, designers, production staff, and external clothing

manufacturers. Sales data, from different geographical locations, is processed

& passed along to designers. This helps the designers to cater their

designs to the preferences of the customers. The effective use of IT makes

Inditex capable to produce very fast turnaround for its fashion designs.

Procurement

Inditex

outsources less production than its competitors. Inditex outsources some of its

standardardized products like cotton T-shirts which are price-sensitive to Asia

as these products have longer shelf lives.

Majority of the

Inditex’s supplier factories are in Spain and Portugal and these factories

specialize in fashion-customised sewing. The proximity of these factories,

specializing in the manufacture of fashionable garments, to the distribution

facility saves time and transportation costs. This allows Inditex to respond quickly

to fashion trends hence reducing its product risk.

Design

The demand in

the fashion apparel industry keeps on fluctuating and any failure to meet the

latest demands can be very risky and deteriorate the customer loyalty. Products

may become out of fashion even before reach shelves. This can undermine the

entire value chain. Hence, to avoid such a risk Inditex encourages continuous

exchange of information between the store managers, designers, procurement

teams and marketing specialists to ensure that the designs are exclusive &

customer driven.

|

| One of the most successful fast-fashion concept chain |

Outbound Logistics

The aim is to

immediately transfer the products rather than storing them. The schedule is

clearly defined which focuses on deadlines on every stage in the supply chain.

This helps to save costs and time by eliminating the need of intermediary

warehouses to store inventory. This effective way of distribution helps Inditex

maintain a strong position in the market.

Marketing and Sales

Inditex’s

marketing budget compared to its competitiors is very less. It infact prefers

to entice customers by selecting prime locations & having its new clothing

displayed in its shop windows.

|

| Exclusive clothing on display |

There are reasons

for this. Firstly, the clothings range changes frequently, hence any

advertising activity has to be in line with the latest clothing ranges and this

might be expensive. Secondly, Inditex avoids over-exposure of its limited

clothing ranges & focusses on the presentation of the stores. It is

interested in creating a climate of exclusivity and scarcity so that customers

are encouraged to buy.